Software Product Disclaimer

Lattice Vision™ is a software product developed and published by Cave and Fire Group Pty Ltd., a registered Australian company operating under the trading name Cave & Fire Lab. Cave and Fire Group Pty Ltd. is a software development company. We are not a financial services provider, broker, dealer, fund manager, investment adviser, or holder of an Australian Financial Services Licence (AFSL). We do not operate in the financial services industry. We make software.

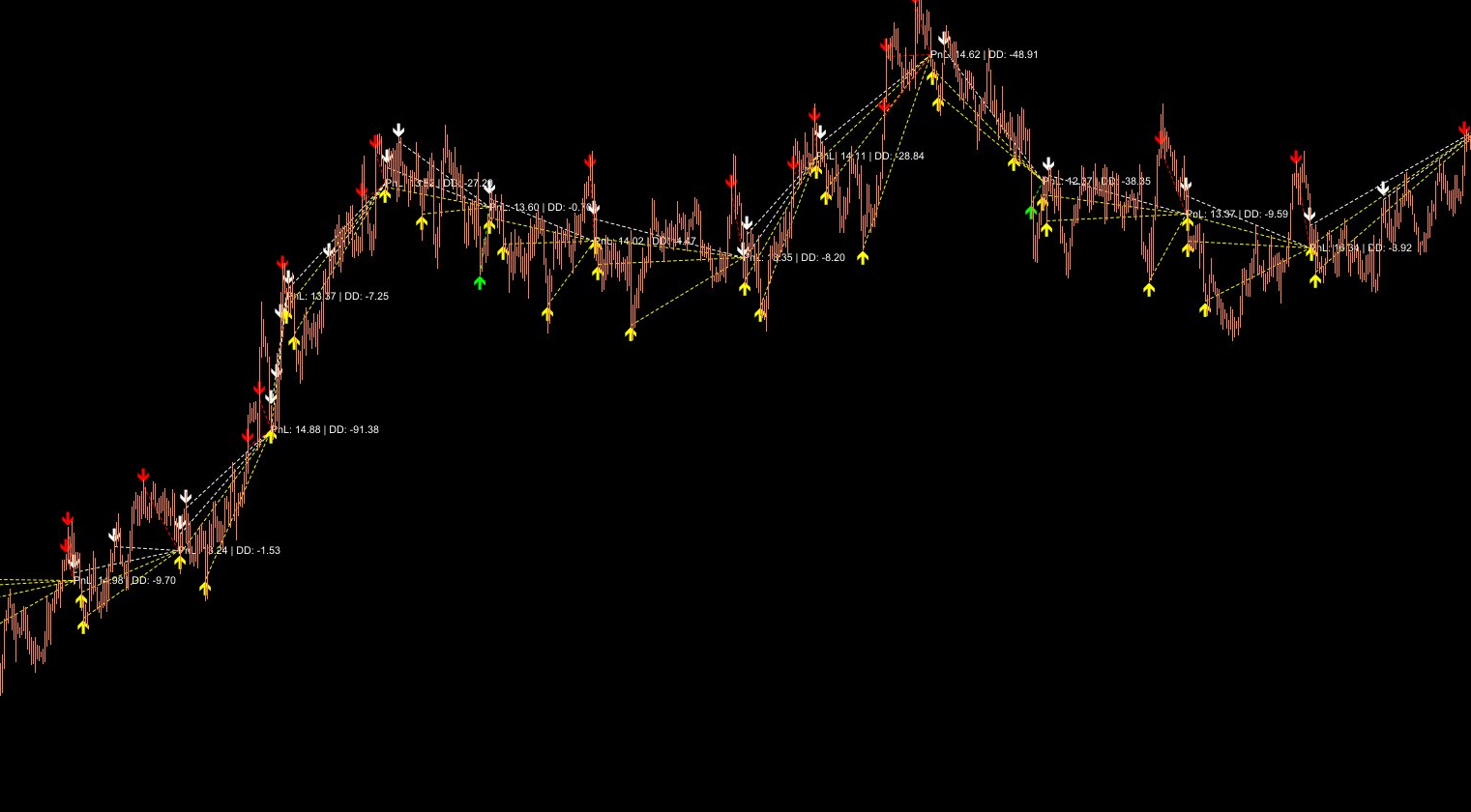

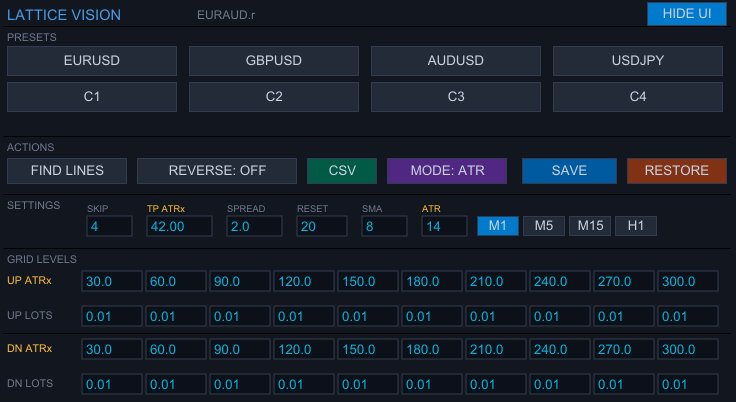

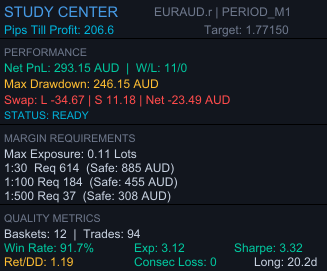

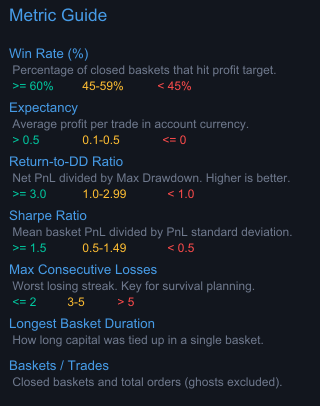

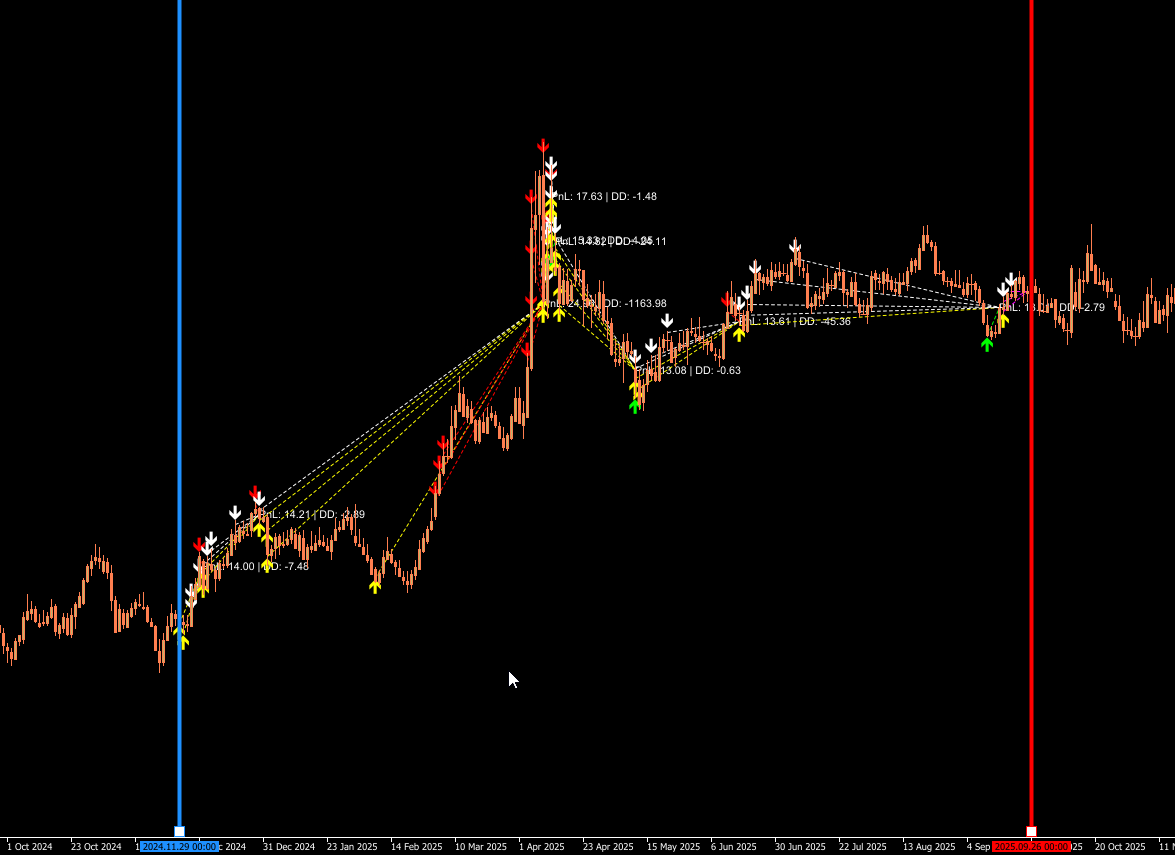

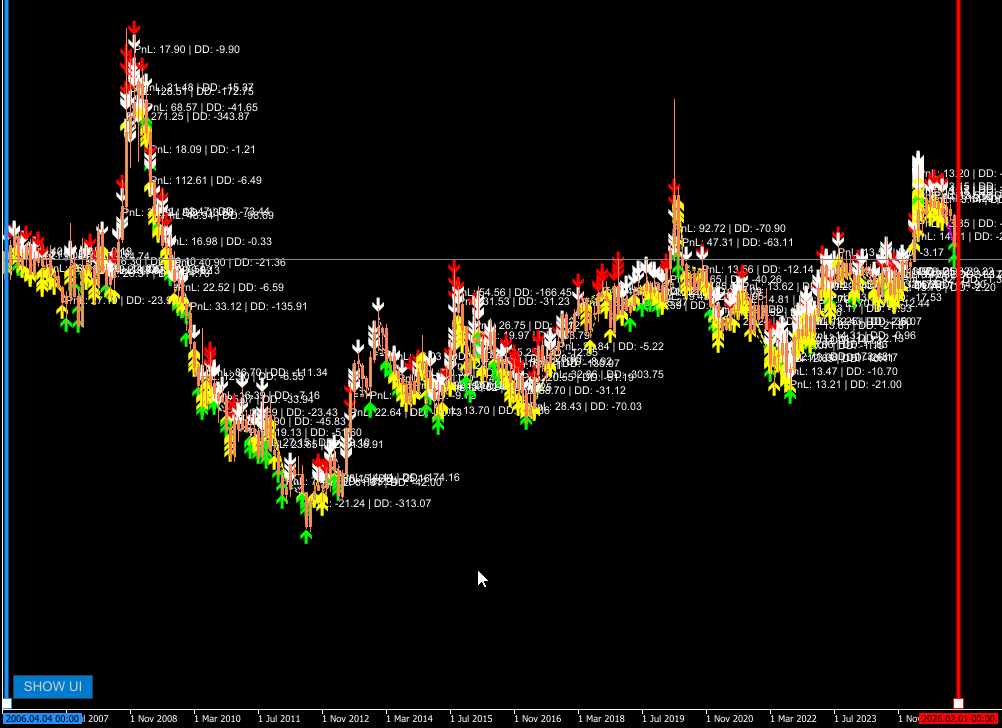

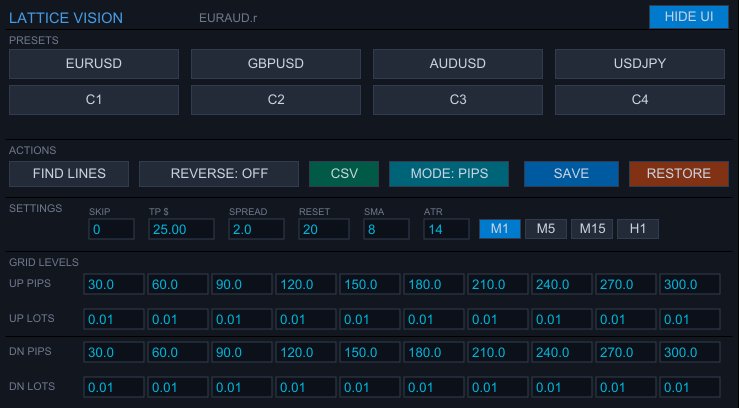

Analytical Tool — Not a Trading System

Lattice Vision™ is a visualisation and analysis tool. It does not place trades, generate trading signals, or execute orders of any kind. All results displayed are simulated, analytical, and visual in nature. The software provides no recommendations, predictions, or prescriptive guidance. It is a measurement and observation utility only.

No Financial Advice

Nothing in this product, its documentation, marketing materials, website content, or any associated communications from Cave and Fire Group Pty Ltd. or Cave & Fire Lab constitutes financial advice, a recommendation to trade, or a solicitation to buy or sell any financial instrument. We do not provide financial advice, trading signals, strategy recommendations, or investment guidance of any kind. All parameters, configurations, and any subsequent decisions based on analytical results are made entirely by the user. Users should seek independent professional financial advice before making any trading or investment decisions.

Use at Your Own Risk

All use of Lattice Vision™ is entirely at the user's own risk. Analytical results produced by this software are based on historical data and user-defined parameters. Past performance — whether observed through this software or any other method — is not indicative of future results. No representation is being made that any configuration will or is likely to achieve profits or losses similar to those displayed. Trading financial instruments involves substantial risk of loss and is not suitable for all individuals.

Software Limitations & Bugs

Like all software, Lattice Vision™ may contain unforeseen bugs, errors, or limitations despite rigorous development and testing. Software is inherently complex and no developer can guarantee that every possible scenario has been anticipated or that the software will operate without error in all conditions. This product is intended for users who understand and accept the inherent limitations of software, including the possibility of unexpected behaviour or calculation errors. Analytical results do not account for execution variables such as latency, slippage, liquidity constraints, or broker-specific behaviour.

Limitation of Liability

To the maximum extent permitted by applicable law, Cave and Fire Group Pty Ltd., its directors, employees, contractors, and affiliates shall not be liable for any direct, indirect, incidental, consequential, or special damages arising from the use of, or inability to use, this software. This includes but is not limited to financial losses, lost profits, trading losses, data loss, or business interruption, regardless of whether such damages were foreseeable or whether Cave and Fire Group Pty Ltd. was advised of the possibility of such damages.

User Responsibility

By purchasing and using this software, users acknowledge that they have read and understood these notices and accept all risks described herein. Users are expected to: understand that analytical results are simulated and may not reflect real-world outcomes; independently validate all results before making any decisions; maintain appropriate risk management practices; ensure their use complies with all applicable laws and regulations in their jurisdiction; and seek independent professional financial advice where appropriate.

Trademarks

Lattice Vision™, Lattice Command™, Ghosting Technology™, and Cave & Fire Lab™ are trademarks of Cave and Fire Group Pty Ltd. MetaTrader 5 and MQL5 are trademarks of MetaQuotes Ltd. All other trademarks are the property of their respective owners.